lake county real estate taxes paid

TAXES PER 100000 ACTUAL VALUE 2021 Mill Levy City- Tax Area 114 112. If you have any questions about how much is owed on your taxes please give us a call 218 834-8315.

Property Taxes Lake County Tax Collector

To pay property tax by phone call 866 506-8035.

. These fees are not retained by Lake County and therefore are not refundable for any reason. Drive Thru open until 330 PM during months of FebJuly. County- Tax Area 191.

Lake County property owners have multiple options for paying their taxes. See Property Records Tax Titles Owner Info More. Please allow 2-3 business days for your online payment to post.

Ad Find County Online Property Taxes Info From 2021. For more information please visit Lake Countys Assessor and Auditor or look up this propertys current valuation. Tangible Personal Property Taxes become delinquent April 1st of each year at which time a 15 fee per month is added to the bill.

Online E-Check you can use this option by changing the drop down from creditdebit to electronic check under payment method. These real estate taxes are collected on an annual basis by the Lake County Tax Collectors Office. After reviewing the Tax Summary click on Tax Bill in the right hand column.

SECOND INSTALLMENT OF REAL PROPERTY TAXES ARE DUE FEBRUARY 1 2022 AND WILL BE DELINQUENT IF NOT PAID BY APRIL 11 2022. Due dates for property taxes are as follows. ALL LENDERS TITLE COMPANIES WITHOUT THE ORIGINAL TAX BILL MUST INCLUDE 5 FOR A DUPLICATE.

Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. All information on this site has been derived from public records that are constantly undergoing change and is not warranted for content or accuracy. 847-377-2000 Contact Us Parking and Directions.

October 15th second half for. Wednesday July 20 2022 Last Day of Payment of 2nd Half of 2021 Taxes. Disable your popup blocker and click Go.

The assessors offices are working in the 2021. While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment. Real Estate taxes can be paid.

Please note that there is a processing fee associated with using a credit card e-check or debit card. Payments that are mailed must have a. Ad Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

Pay Online Please allow three 3 business days to post. Office of the Lake County Tax Collector 320 West Main Street Administrative Office 2nd Floor Suite B Tavares Florida 32778 Phone. Make sure the tax year is set to the right year.

Current Secured and Current Unsecured only. Check out how to pay in person for your property tax bill. As a courtesy to Lake County taxpayers partial payments will be accepted for the current year taxes.

Delinquent Real Estate Advertisments. It may not reflect the most current information pertaining to the property of interest. To mail your payment send check or money order made payable to Lake County Auditor to.

Lake County IL 18 N County Street Waukegan IL 60085 Phone. There is a PIN limit of 10 parcels per transaction. The taxpayer is responsible for delinquent fees and penalties resulting from such unavailability.

The Treasurer-Tax Collectors Office does not guarantee uninterrupted availability of the websites. Lake County IL 18 N County Street Waukegan IL 60085 Phone. Sidebar Menu Skip to Page Content.

Paying Your Taxes. Skip to Page Content Auditor. County w Water Sewer- Tax Area 193.

105 Main Street Painesville OH 44077 1-800-899-5253. Jordan Lake County Tax Collector 320 West Main Street Administrative Office 2nd Floor Suite B. 847-377-2000 Contact Us Parking and Directions.

Building A 2nd Floor 2293 N. Payments are accepted for the next year. Online by Credit Card 25 Fee Applies In person.

With credit card or echeck. IT IS THE RESPONSIBILITY OF EACH PROPERTY OWNER TO SEE THAT THEIR TAXES ARE PAID AND THAT THEY DO INDEED RECEIVE A TAX BILL. May 15th first half for all real estate.

A copy of your tax bill will appear in a new tab. Search all services we offer. View maps of different taxing districts in Lake.

Tangible Personal Property Tax. Renew Vehicle Registration Search and Pay Property Tax Pay Tourist Tax Run a Real Estate report Run a Tangible Property report. Online by phone by mail using the drop box located outside the Law Enforcement Center or in person.

Tax rates real estate tax distribution settlement. Search Any Address 2. Skip to Sidebar Nav.

In accordance with 2017-21 Laws of Florida 119 Florida Statutes. Online E-Check you can use this option by changing the drop down from creditdebit to electronic check under payment method. Pay Mobile Home Property Tax.

School districts get the biggest portion about 69 percent. CAUV Agricultural Districts and Forestry. If the property owner fails to pay the tax debt the property tax deed is sold at a public auction.

Real Estate Tax Rates and Special Assessments. Vendor payments checks paid 440 350-2814 email protected Agricultural Department. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe.

Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes. Lake County Tax Collector 255 N Forbes Street Rm 215 Lakeport CA 95453. Check out your options for paying your property tax bill.

Home Departments Auditor Real Estate Tax Rates and Special Assessments. The collection begins on November 1st for the current tax year of January through December. Find All The Record Information You Need Here.

Unsure Of The Value Of Your Property. 105 Main Street Painesville OH 44077 1-800-899-5253. Enter your pin to find out the status of your tax payment.

Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022. Main Street Crown Point IN 46307 Phone. View or pay property tax online.

Lake County Auditor 601 3rd Ave Two Harbors MN 55616. The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts. This fee is paid to our vendor for the processing.

To pay property tax by phone call 866 506-8035 with credit card or echeck. The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021. For example 2021 taxes are payable and billed in 2022.

Current Real Estate Tax. Call 877 495-2729 Or pay online by clicking the link below.

Property Tax Search Taxsys Lake County Tax Collector

Florida Property Tax H R Block

What Is Florida County Real Estate Tax Property Tax

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

The First Installment Of Property Tax Bills Is Due June 6

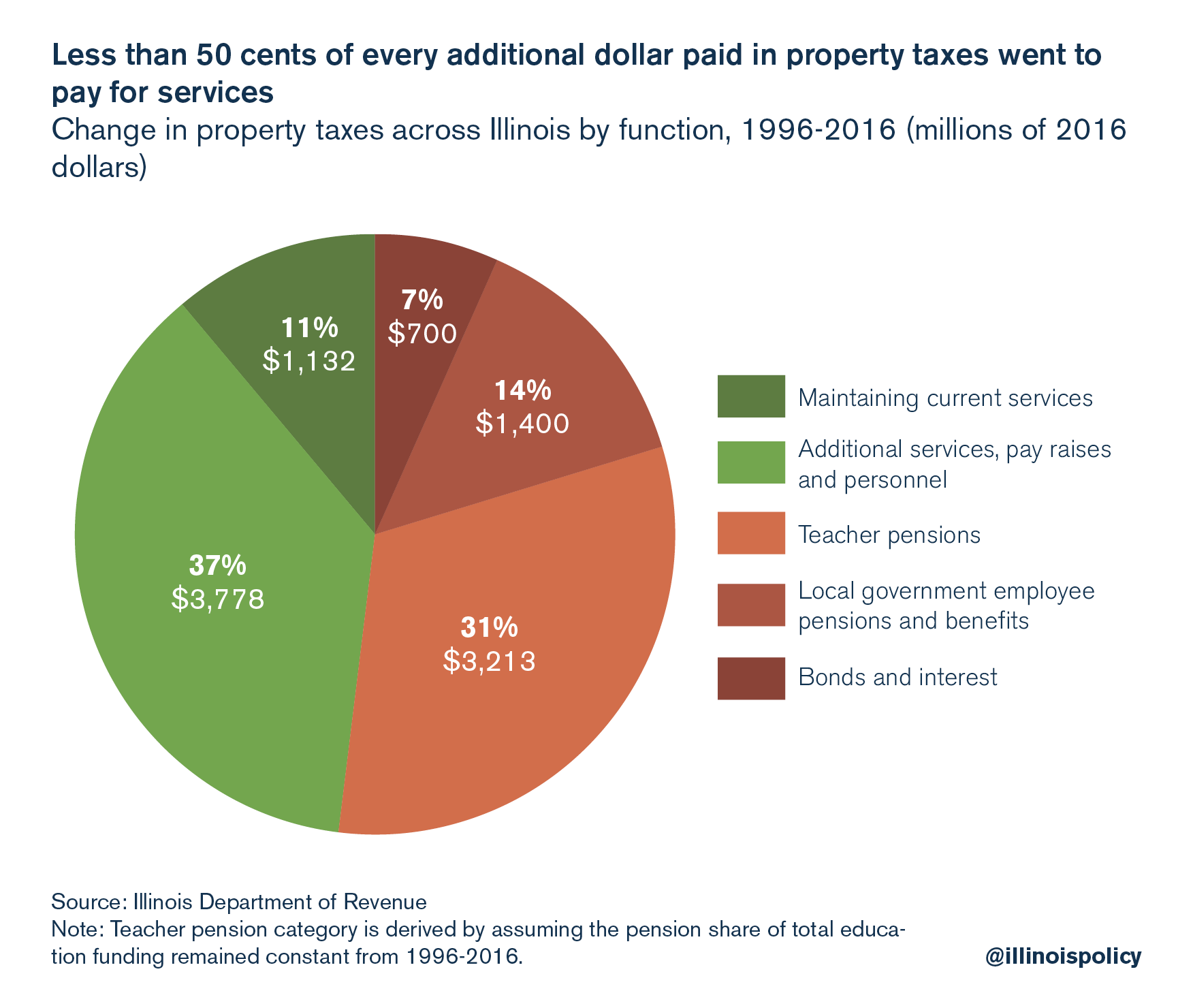

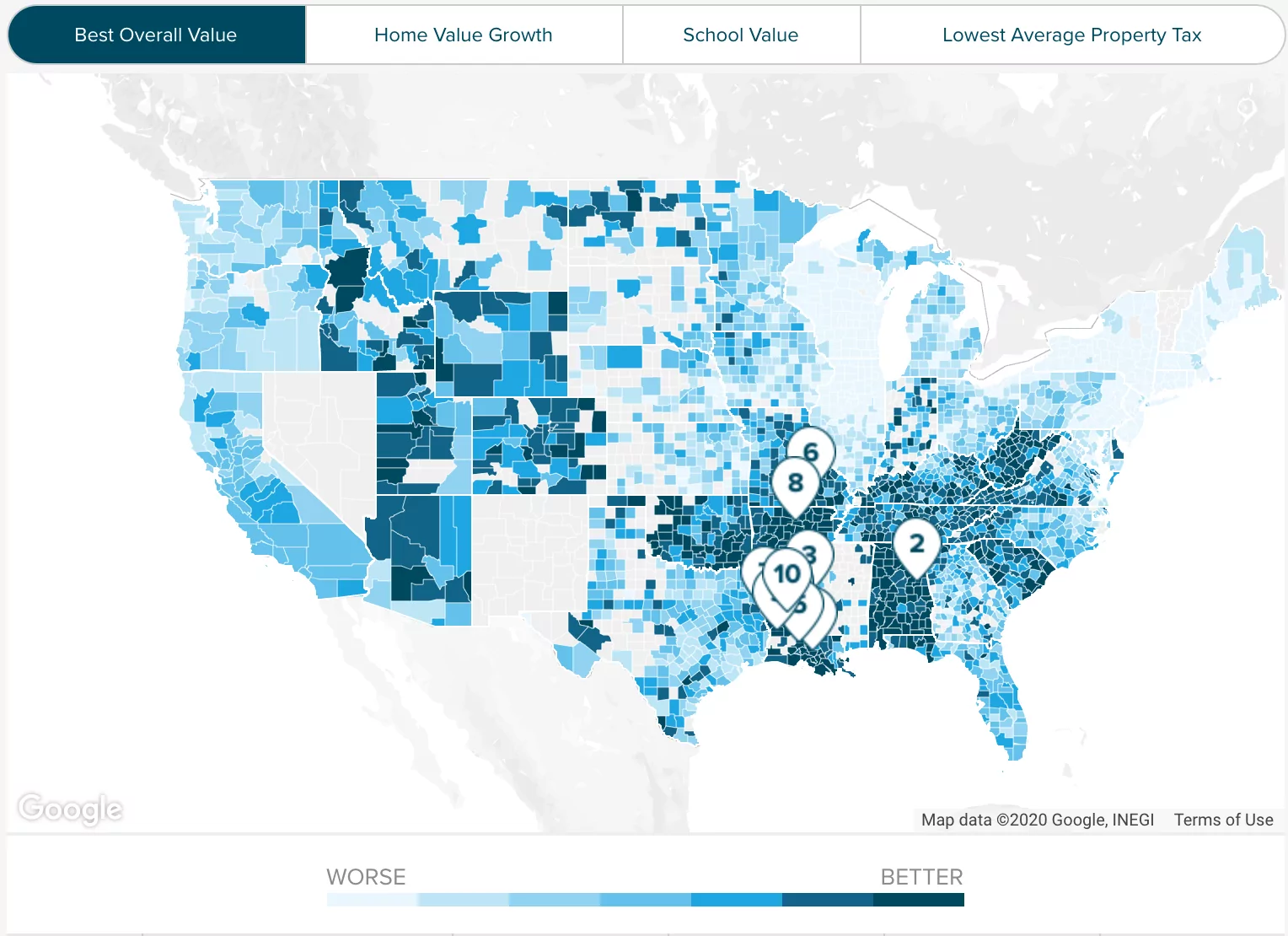

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

The New Age In Indiana Property Tax Assessment

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

The New Age In Indiana Property Tax Assessment

Lake County Appeal Home Facebook

Lake County Appeal Home Facebook

Property Taxes Lake County Tax Collector

Mchenry County Real Estate Tax Bill

Understanding Your Property Tax Statement Cass County Nd

Tangible Personal Property Taxes Lake County Tax Collector

Riverside County Ca Property Tax Calculator Smartasset